2018 Healthcare Prognosis

Last year we all sought to adjust to a new normal as the Trump Administration settled in, with the Affordable Care Act (ACA) in its crosshairs. But as our smart and sophisticated 2017 survey respondents predicted, the ACA lives on. For this year's Healthcare Prognosis, we revisited some topics, like drug pricing and startup health, and added some new questions related to current issues and trends. Once again, we relied on the opinions of a few hundred of the smartest people we know across healthcare.

Our key findings are presented below.

I. Shaking It Up

New entrants are joining the effort to change healthcare for the better, but will they be successful?

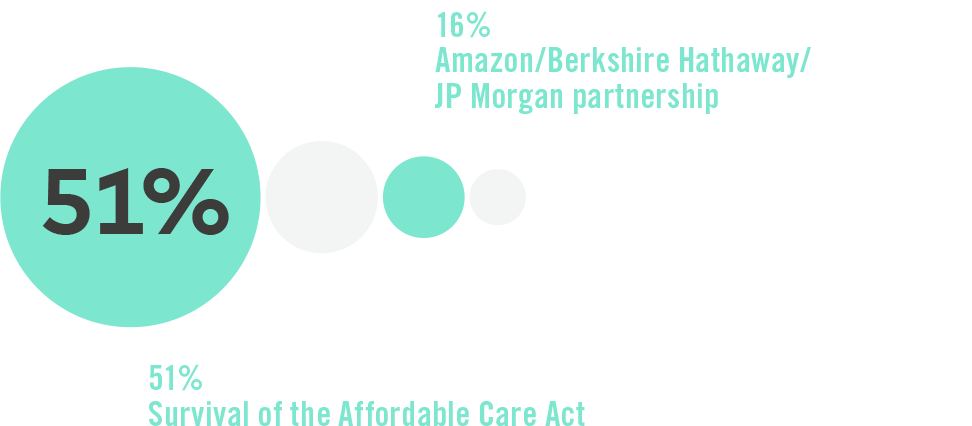

Despite the press, healthcare experts are dubious on the Amazon/Berkshire Hathaway/ JP Morgan partnership

The partnership trailed both the survival of the Affordable Care Act and the CVS/Aetna deal as the most important healthcare event in the last year.

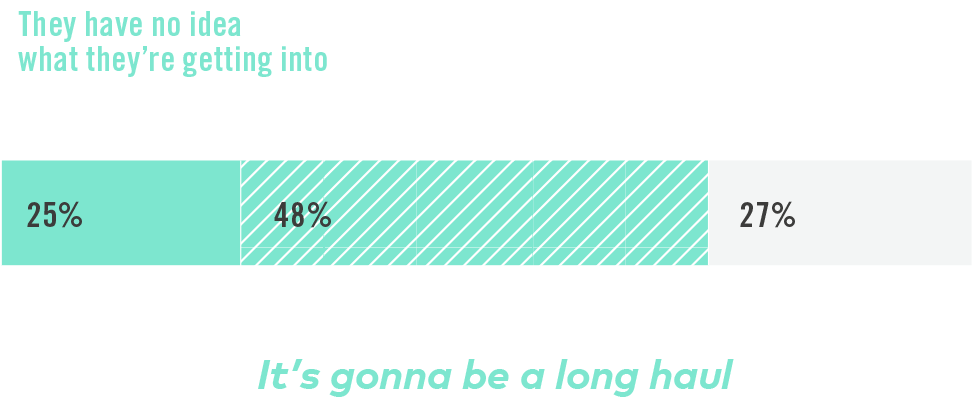

73% of respondents felt that the Amazon/Berkshire Hathaway/JP Morgan effort was going to face substantial challenges and take lots of time, underscoring the lack of perceived near-term significance.

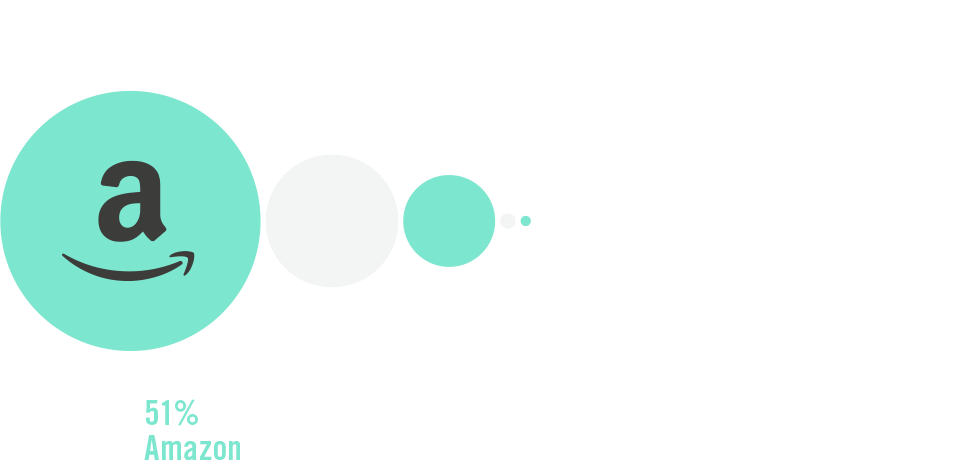

The Amazon effect

Amazon is shaking up industries from retail to entertainment, and the latest sector in its sights is healthcare. The majority selected Amazon and Apple as the companies most likely to make progress in healthcare in 2018.

II. About Trump

The healthcare industry is adjusting to a new normal under Trump.

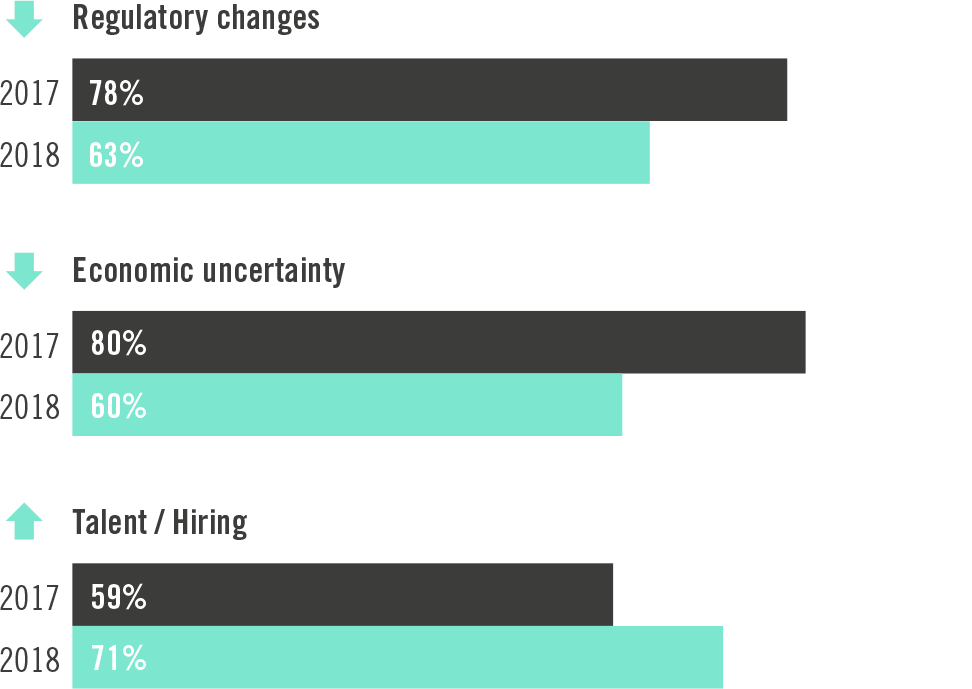

Concerns change

Last year respondents were concerned about how regulatory changes and economic uncertainty would affect innovation. This year, however, talent and hiring is the main worry thanks to rumored changes to H-1B visas and other immigration programs.

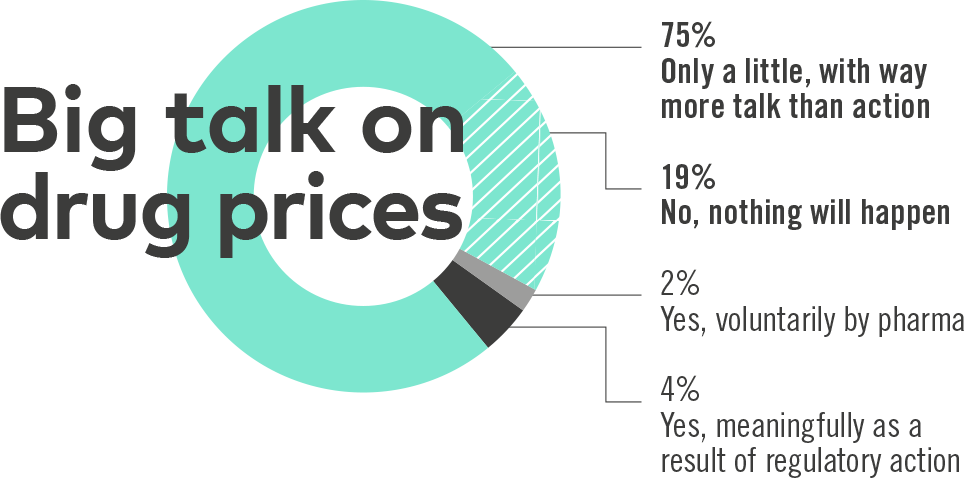

Despite Administration and FDA rhetoric, skepticism remains high that the drug pricing debate leads anywhere

The majority believe there will still be more talk than action on prescription drug prices. This serves as a challenge to those in power to actually get something done—and soon.

III. Startup Crystal Ball

Last year new companies emerged and other continued to grow and (mostly) prosper, while exits remained elusive. What's on tap for healthcare IT companies in 2018 and beyond?

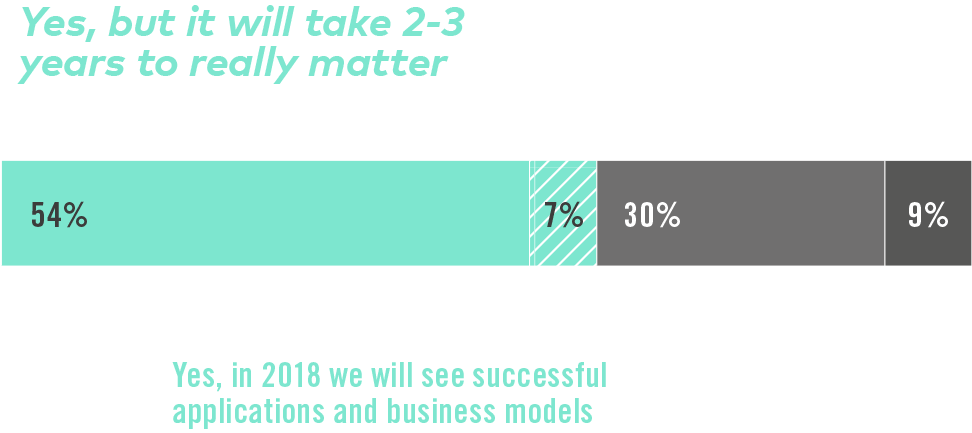

AI in healthcare: important but early

Expectations are high for AI to make a difference in healthcare, but it will be awhile before we see real-world use cases.

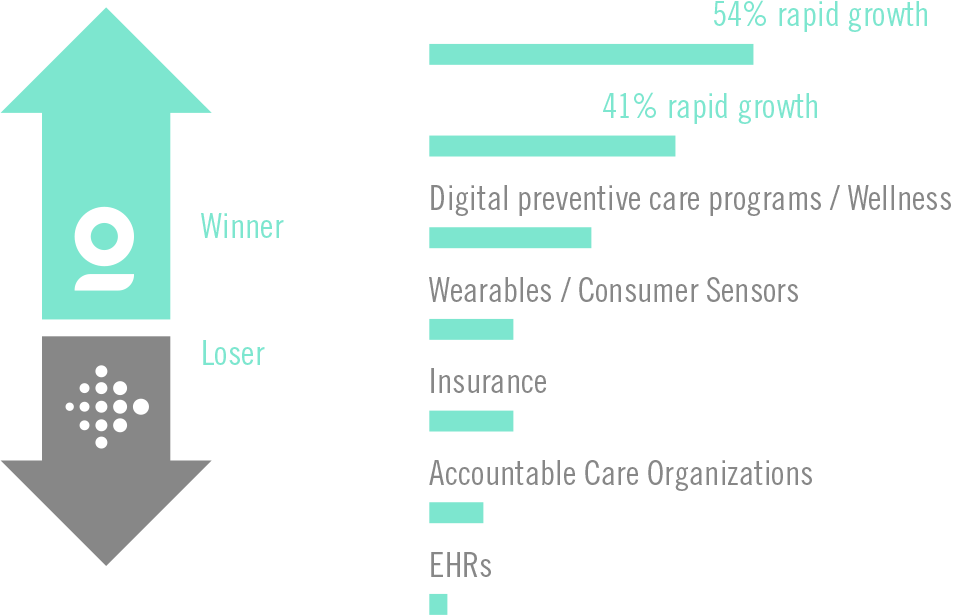

Telemedicine gaining real traction

Confidence is high that Teladoc's stock will rise while respondents expressed concern about Fitbit and the wearables industry. Similarly, telemedicine and big data/analytics sectors are expected to grow over the next 12 months, while wearables/consumer sensors and EHRs are expected to decline.

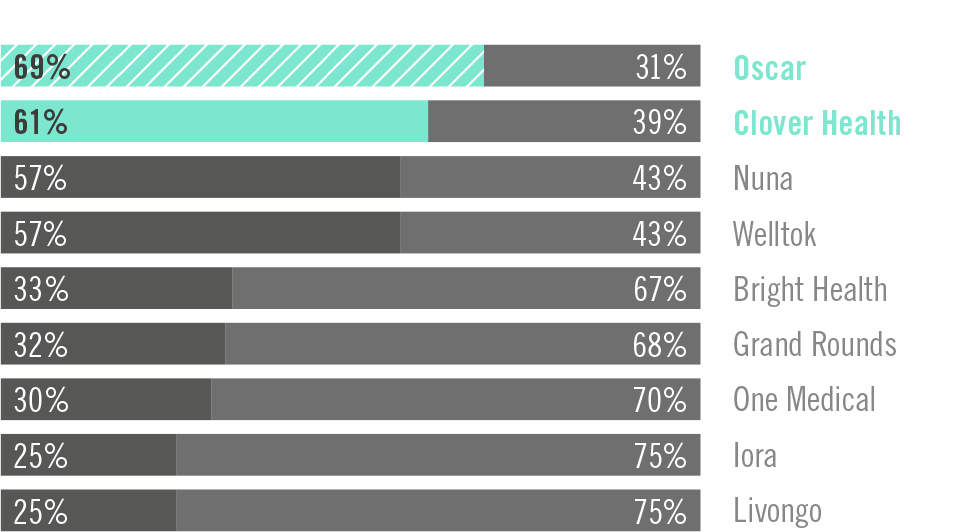

Insurance of the future?

People are worried about bad news from insurance companies, including Oscar and Clover Health, while care providers Iora and One Medical have rosier expectations.

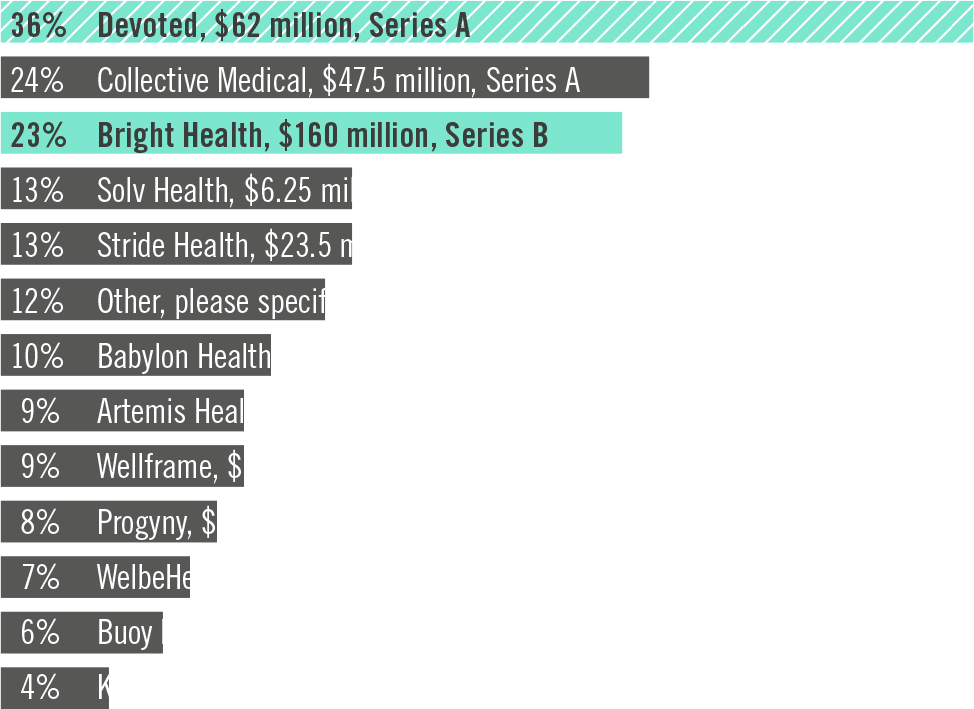

However, when asked to put on their investor hat and indicate which 2017 early stage financings they regret not having been in, the majority picked Devoted Health and Bright Health, part of the new wave of startups tackling the insurance industry.

Ticker watch

Will the IPO market pick up in 2018? IPOs predicted as most likely for One Medical, Health Catalyst and Grand Rounds, according to our respondents.

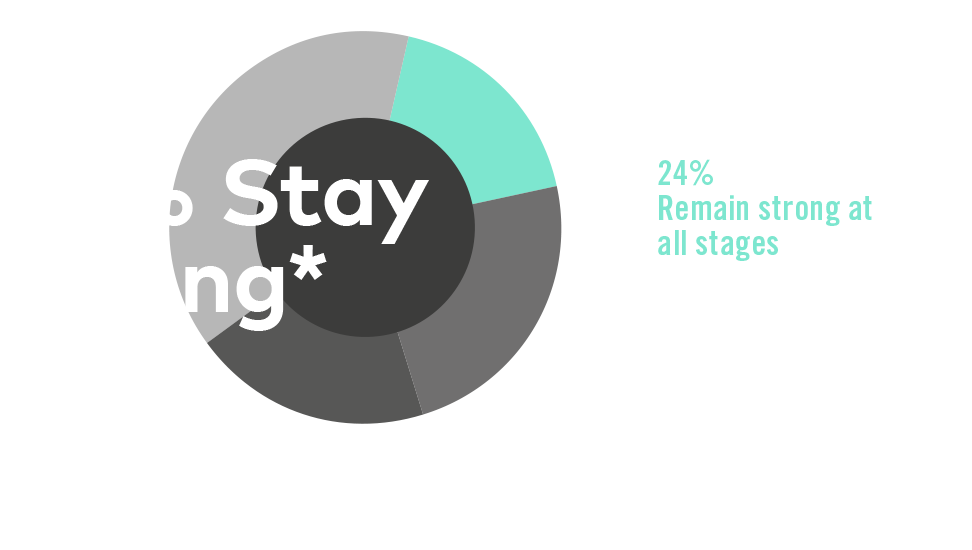

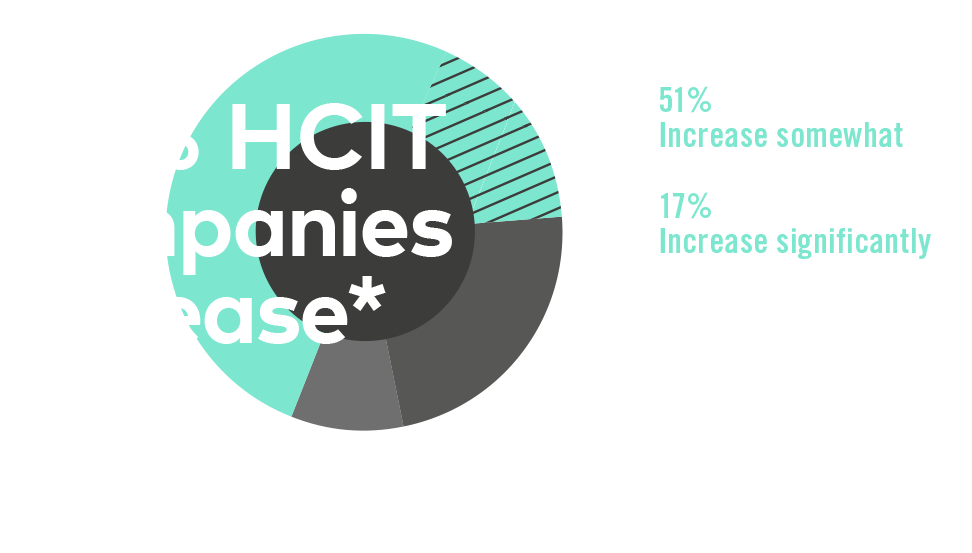

Outlook is rosy for healthcare IT companies

Our respondents have increased optimism about the capital markets and creation of new HCIT companies this year, thanks to the stock market's continued rise and plentiful venture funding for this sector.

Full Survey Results

We conducted the survey from February 26, 2018 - March 16, 2018. The 300 respondents represent health IT startups, large employers, insurance companies, healthcare providers, academics, the government, investors and professional service providers.

1

In the past year, what

has been the most

important healthcare

event?

| 51% | Survival of the Affordable Care Act |

| 22% | CVS/Aetna deal |

| 16% | Amazon/Berkshire Hathaway/JP Morgan partnership |

| 1% | Scott Gottlieb becoming FDA Commissioner |

2

Will prescription drug

prices be curtailed in

the next 4 years?

| 4% | Yes, meaningfully as a result of regulatory action |

| 75% | Only a little, with WAY more talk than action |

| 2% | Yes, voluntarily by pharma |

| 19% | No, nothing will happen |

3

Which private

companies will have

the biggest good or

bad news in 2018?

| Good news | Bad news | |

| Bright Health | 67% | 33% |

| Clover Health | 39% | 61% |

| Grand Rounds | 68% | 32% |

| Iora | 75% | 25% |

| Livongo | 75% | 25% |

| Nuna | 43% | 57% |

| One Medical | 70% | 30% |

| Oscar | 31% | 69% |

| Welltok | 43% | 57% |

4

Which of these

companies will make

the most progress in

healthcare in 2018?

| 51% | Amazon |

| 26% | Apple |

| 18% | |

| 3% | IBM |

| 2% | Microsoft |

5

Which public company

will see the greatest stock price appreciation

in 2018?

| 8% | BenefitFocus (NASDAQ: BNFT) |

| 17% | Castlight (NYSE: CSLT) |

| 19% | Evolent Health (NYSE: EVH) |

| 3% | Fitbit (NYSE: FIT) |

| 6% | Tabula Rasa HealthCare (NASDAQ: TRHC) |

| 46% | Teladoc (NYSE: TDOC) |

6

What does the future

hold for the Amazon/Berkshire Hathaway/JP

Morgan healthcare partnership?

| 27% | They just might pull this thing off |

| 48% | It's gonna be a long haul |

| 25% | They have no idea what they're getting into |

7

Total insurance

individual market coverage in the US

(ACA enrollment + Medicaid + Medicaid expansion) in

2018 will (off the 2017 baseline of 21M):

| 24% | Grow |

| 67% | Tread water |

| 9% | Plummet |

8

Will AI make a

difference in healthcare?

| 7% | Yes. In 2018 we will see successful applications and business models |

| 55% | Yes. But it will take 2-3 years to really matter |

| 30% | Maybe. But healthcare adopts technology slowly |

| 9% | No. It is hype and just a new name for "big data" |

9

Which of the following

2017 early stage (A & B) financings

do you regret not having been in?

| 9% | Artemis Health, $22.7 million, Series B |

| 10% | Babylon Health, $60 million, Series B |

| 23% | Bright Health, $160, Series B |

| 6% | Buoy Health, $6.7 million, Series A |

| 24% | Collective Medical, $47.5 million, Series A |

| 36% | Devoted, $62 million, Series A |

| 4% | Kinsa, $17 million, Series B |

| 8% | Progyny, $83 million, Series B |

| 13% | Solv Health, $6.25 million, Series A |

| 13% | Stride Health, $23.5 million, Series B |

| 7% | WelbeHealth, $15 million, Series A |

| 9% | Wellframe, $15 million, Series B |

| 12% | Other, please specify |

10

Which of the following 2017

later stage (Series C on) financings do you

regret not having been in?

| 13% | Amino, $25 million, Series C |

| 29% | Clover, $130 million, Series D |

| 38% | Livongo, $52.5 million, Series D |

| 10% | Mango Health, $9.3, Series C |

| 17% | Nuna, $90 million |

| 17% | Welltok, $25.9 illion, Series E2 |

| 9% | Other, please specify |

11

Who will be the next HCIT company(ies) to go public?

| 14% | Doximity |

| 23% | Grand Rounds |

| 31% | Health Catalyst |

| 13% | Landmark |

| 34% | One Medical |

| 14% | Oscar |

| 1% | SciOx |

| 17% | Welltok |

| 19% | Zocdoc |

| 4% | Other, please specify |

12

Will the following healthcare IT sub-sectors

experience growth (e.g., some combination

of new entrants, influx of capital, customer traction) in the next 12 months?

| Accountable Care Organizations | |

| 9% | Rapid growth |

| 61% | Some growth |

| 24% | No growth |

| 6% | Growth declines |

| Wearables / Consumer Sensors | |

| 14% | Rapid growth |

| 53% | Some growth |

| 21% | No growth |

| 12% | Growth declines |

| Insurance | |

| 14% | Rapid growth |

| 55% | Some growth |

| 28% | No growth |

| 3% | Growth declines |

| Telemedicine | |

| 41% | Rapid growth |

| 53% | Some growth |

| 5% | No growth |

| 0% | Growth declines |

| EHRs | |

| 3% | Rapid growth |

| 46% | Some growth |

| 42% | No growth |

| 9% | Growth declines |

| Digital preventative care programs / wellness | |

| 27% | Rapid growth |

| 55% | Some growth |

| 14% | No growth |

| 4% | Growth declines |

| Analytics and big data | |

| 54% | Rapid growth |

| 41% | Some growth |

| 4% | No growth |

| 1% | Growth declines |

13

How concerned are you about each of the following

challenges to healthcare IT innovation in the next 12 months?

| Talent / Hiring | |

| 25% | Very concerned |

| 46% | Somewhat |

| 22% | Neutral |

| 7% | Not at all |

| Regulatory changes | |

| 18% | Very concerned |

| 45% | Somewhat |

| 27% | Neutral |

| 10% | Not at all |

| Economic uncertainty | |

| 16% | Very concerned |

| 44% | Somewhat |

| 31% | Neutral |

| 9% | Not at all |

| Competition | |

| 13% | Very concerned |

| 38% | Somewhat |

| 37% | Neutral |

| 12% | Not at all |

| Funding | |

| 10% | Very concerned |

| 28% | Somewhat |

| 32% | Neutral |

| 30% | Not at all |

14

What will happen to the capital markets for private HCIT companies?

| 24% | Remain strong at all stages |

| 20% | Remain strong for early / get harder for growth |

| 39% | Get harder for early / remain strong for growth |

| 18% | Get tough at all stages |

15

Over the next twp years, the creation of new healthcare IT companies will:

| 17% | Increase significantly |

| 51% | Increase somewhat |

| 23% | Stay the same |

| 9% | Decrease |

16

What does the future hold for hospital consolidation?

| 59% | Speed up to consolidate market power prior to MACRA going into effect |

| 10% | Slowdown due to emboldened FTC |

| 30% | Slowdown due to inability to create value as larger health systems |